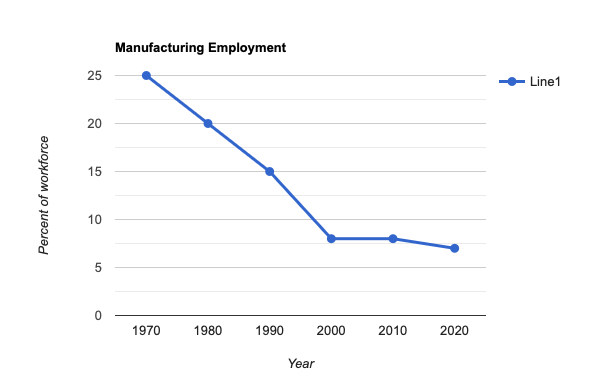

According to the Tax Foundation, employment in manufacturing declined steadily from 25% of the U.S. workforce in 1970 to less than 10% in 2010. However, the percentage of American jobs in manufacturing has remained fairly steady since then.

From a peak of approximately 17.3 million jobs in 1970, manufacturing employment steadily decreased to just under 12 million jobs in 2010. This decline was largely due to a combination of factors, including increased automation, offshoring of jobs, and outsourcing to lower-wage countries.

The Great Recession had some impact on manufacturing employment. In 2008, the United States experienced a significant economic downturn, which resulted in some decline in manufacturing employment, but coincided with a push toward reshoring that has kept manufacturing employment relatively flat since then.

What does this have to do with taxes?

The Tax Foundation’s focus is on the impact of tax policies and industrial policies on manufacturing employment. The chart shows that the enactment of tax and industrial policies had a positive effect on manufacturing employment during the Great Recession period. For example, the American Recovery and Reinvestment Act (ARRA) of 2009 provided tax incentives for businesses to invest in new equipment and facilities, which resulted in an increase in manufacturing employment. Similarly, the chart shows that industrial policies, such as the Manufacturing Extension Partnership (MEP), which provided technical assistance to small and medium-sized manufacturers, also had a positive effect on manufacturing employment.

The “Made in America” trade policies were enacted in 2017 with the aim of reducing the trade deficit and promoting domestic manufacturing.The “Made in America” trade policies had a small positive effect on employment, but it is still unclear whether these policies will be effective in reversing the long-term decline in manufacturing employment in the United States.

The Tax Foundation claims that “the existing tax code has a structural bias against manufacturing and capital-intensive businesses broadly. By forcing companies to spread deductions for capital investments out over long periods of time, the code creates a tax bias in favor of services firms with high labor costs and low capital costs, and against firms with high capital costs and low labor costs.”

This, they figure, penalizes companies with high levels of productivity and large investments in automation. They believe that changing this tax structure would do more for U.S. manufacturing than tariffs or subsidies.

Could that overcome the job loss brought about by automation and offshoring? We may never know.

We do know that when you need service or support for your Rexroth electric drive and control systems, we can get you back up and running fast. Call us for immediate assistance.